What is OSAP

The Ontario Student Assistance Program (OSAP) is a government-sponsored program designed to act as a supplementary means for funding a student's educational costs where the parents, spouse, and student have demonstrated an inability to meet these costs.

St. Clair College : Financial Aid Office

Monday to Thursday - 9:00am to 4:30pm

Friday - 10:00am to 4:00pm

Room A1343 (Windsor) and Room W1022A (Chatham)

Address: 2000 Talbot Rd.W., Windsor, ON N9A6S4

Email: financialaid@stclaircollege.ca

Phone: 519-972-2718

Website: https://www.stclaircollege.ca/financial-aid

Please refer to this website for help: https://www.stclaircollege.ca/financial-aid/osap/help or contact the Financial Aid Office at financialaid@stclaircollege.ca.

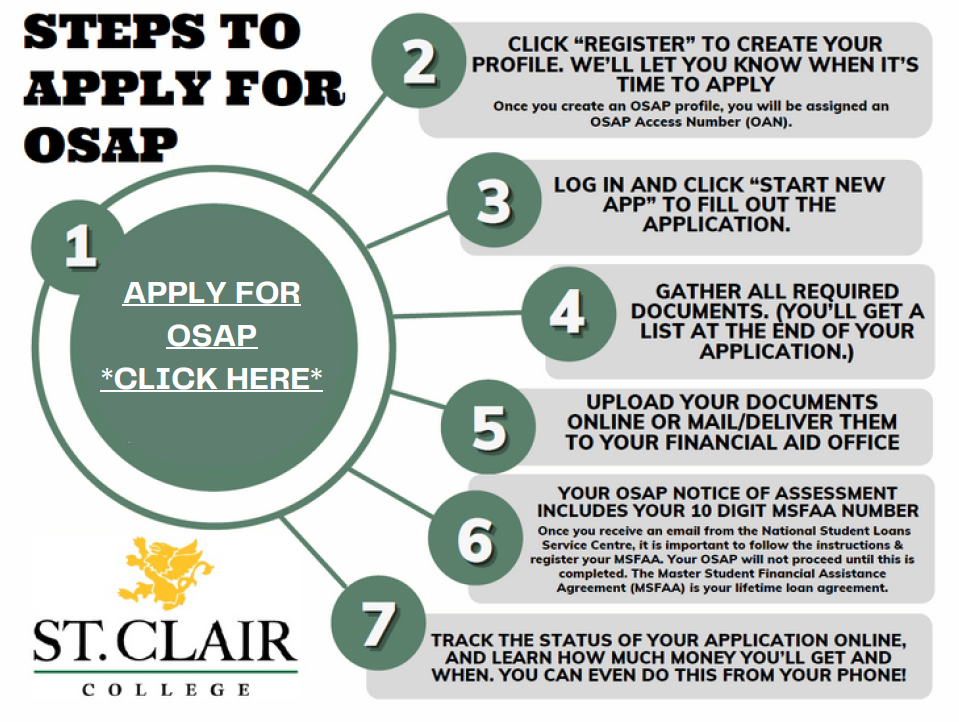

Applying for OSAP

The recommended method to apply for OSAP is on-line at www.ontario.ca/osap. If this is your first time registering for OSAP, you will receive an OSAP Access Number (OAN). Keep this number in a safe place—you will need it to access your account.

We suggest applying at least 3 months before the start of your study period to avoid delays with your funding.

MSFAA is a document added to the OSAP process to allow for OSAP funding to be directly deposited into the student’s personal banking account. The MSFAA must be processed in order to receive OSAP funding. Your OSAP Notice of Assessment includes your 10 digit MSFAA number. Once you receive an email from the National Student Loans Service Centre, it is important to follow the instructions & register your MSFAA. Your OSAP will not proceed until this is completed.

The Master Student Financial Assistance Agreement (MSFAA) is your lifetime loan agreement.

Your course load refers to the number of courses you are taking. Most students are enrolled in 100%of a course load. The minimum course load to apply for full-time OSAP is 60% (if you have identified a shaving a permanent disability, the minimum course load is 40%).

Yes, the online application, which is shorter for continuing students, should be available around April each year on the OSAP website.

To check the status of your OSAP application:

Log on to your OSAP web account and click “Check Status”

- You will be able to find out:

- If your application has been processed

- If you have any outstanding documents you need to provide

- If you or your school have to provide information

- How much money you’ll get

- When your money will be disbursed

Your OSAP Message Centre also provides information and status updates related to your application.Please check your Message Centre regularly; you are responsible for monitoring your application and all communications.

Online: Click on the “Forgot OAN or Password” link on the OSAP login page and use your challenge questions

- In person: Visit the Financial Aid Office of any college or university. Make sure you bring your Social Insurance Number card and one piece of valid government-issued photo I.D. to confirm your identity at the Financial Aid Office

- Download the “OSAP Website: Forgot Password and/or OSAP Access Number (for student)” form from the OSAP website and mail it directly to the Ministry of Colleges and Universities with supporting documents.

Keywords can be helpful in searching for your program name. If you're not able to find your exact program name or semester, select the closest program and this will be corrected automatically by the Financial Aid Office. Please make sure you provide your correct Student Number on your OSAP application form. Alternatively, you can email the Financial Aid Office at financialaid@stclaircollege.ca

At the time you submit your online application you may view an estimate of your entitlement. This is an estimate only and should not be considered as your actual entitlement. Once your application is complete and all supporting documentation processed, you may view your actual entitlement by logging on to your OSAP account and clicking “Check Status”. It is your responsibility to monitor the status of your application and to submit all required documentation in a timely manner.

The deadline to submit a complete full-time OSAP application is 60 days before the end of your current full-time study period.

The deadline to submit full-time OSAP supporting documents is 40 days before the end of your current full-time study period.

You must confirm your income before the release of your second installment of OSAP funds. It is your responsibility as a borrower to inform OSAP of any changes in your financial situation throughout the school year. Instructions will be sent to you by the Ministry about one month before your second installment of OSAP is scheduled to be released. Check your email or online OSAP status regularly for instructions. Please see the Financial Aid Office to report any income changes from your original application. It is important that you report your income promptly. Delay in reporting income may result in an OSAP over payment or restriction. Please note that you may not make further changes to your income after the study period has ended.

Based on your OSAP status, you may be required to provide parental/spousal income information, and your application will be assessed based on this income information. Once your parent(s)/spouse file their income tax return(s) with the Canada Revenue Agency (CRA), and the information is verified by OSAP, your OSAP funding will be reassessed. If they do not file a tax return with CRA (e.g. they have foreign income), additional documentation may be required to prove their income. For further information, check your status online or contact the Financial Aid Office.

Uploading Documents

It is highly recommended to upload your signature pages & other supporting documentation on theOSAP website. If you cannot upload your documents, you can submit them to your Financial Aid Office at financialaid@stclaircollege.ca. Or, in person: in Windsor: Room 166 or fax to 519-972-2797; in Chatham: Room 134A or fax to 519-354-6941. Signature pages (and most supporting documents) only need to be submitted with your first OSAP application. They will remain valid for your entire academic career, unless there is a break of two years or more in your studies.

For help with uploading your documents, please see:

You can create a PDF version of your supporting documents directly from your phone.

Here are some free phone applications that you can use to scan documents as PDF:

- CamScanner (for iOS or Android users)

- ScanBot (for iOS or Android users)

- Evernote Scannable (for iOS users)

- Adobe Scan (for iOS users)

- Notes (for iOS users)

Once you create a PDF on your phone, you can email the documents to yourself to upload onto your OSAP portal— it is easier to upload the actual documents directly from a computer.

How to scan documents from a computer

You can also scan your documents as a PDF onto your computer, then upload them to your OSAP portal. Please ensure that your documents are formatted as follows:

- PDF format

- Scanned as black and white

- 2 megabytes (MB) or less in file size. PDF files that are larger than 2 MB (or 2,000 kilobytes/KB) must be compressed. Otherwise, the file will be too large to upload on the OSAP portal

- When scanning, scan at 72 to 120 dots per inch (DPI)

- Select a text style canning option rather than a photo or picture option

More information about scanning and uploading your supporting documents can be found on your Supporting Document page of your OSAP application.

Making Changes or Updates to your OSAP Application

You can update your bank information online by logging on to your NSLSC account. Or you can complete the Bank Account Change Request Form and fax the completed form to 1-866-658-8801. You can retrieve this form from the National Student Loans Service Centre website at https://www.csnpe-nslsc.canada.ca/en/home or from your Financial Aid Office.

If you need to make a change to your OSAP application after you have submitted it for processing, you will need to put your change in writing. Please be sure to sign and date your letter and to include your student number. You can email your request to financialaid@stclaircollege.ca, mail it, fax it to 519-972-2797 or drop off your letter in person to your Financial Aid Office.

OSAP recipients must keep their address and contact information up to date with the Ministry, National Student Loans Service Centre (NSLSC) and St. Clair College.

- OSAP: Log in to your OSAP account to change your address

- National Student Loans Service Centre: 1-888-815-4514 or www.nslsc.ca

- St. Clair College: Update on your self-service Student Information System

Receiving your OSAP funding

First, you will receive an estimate of funding based on the information provided in your application.

Second, you must submit/upload all required documents to complete the application process.

Once the Financial Aid Office processes your documents, you will have a complete application as well as your final OSAP assessment.

Lastly, the release of funds happens 1-2 weeks before the semester starts and can take up to 7-10 days to be deposited into your account.

No. OSAP is an assistance program. OSAP is designed to supplement the expected contributions of student and parents. A student’s decision to pursue post-secondary studies comes with financial obligations and a responsibility to contribute to it. Education is a valuable investment in reaching future aspirations. Once OSAP has determined the amount of funding you are entitled to, it is the student’s responsibility to budget accordingly.

St. Clair College starts confirming student enrollments electronically the week before the start of each study period. If the status on your OSAP account shows 'Confirmation of Enrollment', that means that OSAP is waiting for the College to confirm your enrollment for the next installment of your OSAP funding. You must be registered in your courses before the College can confirm your enrollment. Funding will be released after the start of your study period. After your enrollment has been confirmed, funding normally takes 7-10 business days to be deposited to either your school tuition account or your bank account.

Every semester, the student is responsible to ensure their fees have been paid in full.

The OSAP system is designed so that OSAP will remit tuition fees for one semester directly to the school with each release of funds. Funding is released on two separate occasions – September and January only. In a program with three terms, it is your responsibility to pay the third term with any remaining OSAP funds that were deposited to your bank account.

Sometimes there are issues that prevent funds from being released to the school, and some students are not assessed enough to cover their costs. Please check your Funding Summary screen on the OSAP site for release information, and your SIS account for payments and outstanding balances.

Your Federal and Provincial funds are deposited separately; they are usually 3 business days apart.

If you have not received your funds after 10 business days of the Financial Aid Office confirming your enrollment, Please call the financial aid office for next steps (This could consist of contacting the National Student Loans Service Centre at 1-888-815-4514)

No, OSAP is released 7-10 business days after your enrollment is confirmed (usually 1-2 weeks before the start of classes). The tuition deadline date is for students not in receipt of OSAP. OSAP will automatically redirect funding directly to your student account, and any remaining funds will be deposited into your personal bank account. If, for some reason, your tuition is not directed correctly, it is the student’s responsibility to ensure their tuition gets paid from the funding deposited to their bank account.

If you're assessed for both grants and loan funding, but don't want the loan, you can decline it. Just select the “No” Loan Option that appears on your OSAP application funding summary. Or you can complete a Grant Funding Only review form that can be found on the OSAP website (https://osap.gov.on.ca/OSAPPortal/en/PostsecondaryEducation/OSAP/Forms/), or through the Financial Aid office.

OSAP uses standard criteria to assess a student’s financial need and to determine the amount of funding you may be eligible to receive. There may be situations, however, where the criteria may not adequately reflect your particular circumstances. If this is the case, you may request a review of your OSAP application.

The first step for you in the review process is to contact the Financial Aid Office at your institution.They will review your file and make a decision.

Out of Province Financial Aid

To qualify for OSAP, you must meet the OSAP residency requirements: https://www.ontario.ca/faq/whos-considered-ontario-resident-osap-purposes

If you are considered a resident of another province or territory within Canada, you may be eligible for student loans even if you move to Ontario to study.

Visit the financial aid website for your province or territory to learn more about available resources.

- Alberta Student Aid:

- British Columbia Student Aid:

- Manitoba Student Aid:

- New Brunswick Student Financial Services:

- Newfoundland and Labrador Student Aid:

- Northwest Territories Student Financial Assistance:

- Nova Scotia Student Assistance:

- Nunavut Student Funding:

- Prince Edward Island Student Financial Services:

- Quebec Student Financial Aid:

- Saskatchewan Student Loans:

- Yukon Student Financial Assistance:

Unforeseen Circumstances

Students must maintain satisfactory academic progress. That means that students are required to successfully complete the academic requirements of their program to continue to be eligible for OSAP. Frequent or multiple program switches, drops, withdrawals and/or repeats of programs that are funded by OSAP may be considered lack of academic progress and direction. Please contact your Financial Aid Office before making any course load changes.

Consequences to withdrawing from full-time studies or dropping to part-time status while on OSAP may include:

- Your loans will become repayable 6 months after you withdraw from full-time studies

- An overpayment will be created due to a reassessment of your OSAP entitlement as a result of your withdrawal or drop

- There will be OSAP Academic probation or restriction placed on

Full-time OSAP applicants

- If you drop one or more courses but remain in a full-time course load, you will remain eligible for OSAP.

- If you drop to a part-time course load or withdraw from all your courses, you will lose OSAP eligibility for the rest of the semester and you will likely see a decrease in your funding assessment. Dropping courses always poses a risk of having OSAP overpayments, grant to loan conversion, and being placed on OSAP academic probation.

Part-time OSAP applicants

- If you drop one or more courses during a term that you received part-time OSAP, you will be required to self-fund for the next semester during which you apply for part-time OSAP and pass all the courses you take that semester.

Please note this is not related to your St. Clair College (GPA) or academic standing. OSAP Academic Progress Warnings and Restrictions are different from being placed on academic probation with your program.

Common reasons why students may be placed on OSAP Academic Progress/Probation include, but are not limited to:

- Not successfully completing a 60% course load each term (40% course load for students with a permanent disability)

- Dropping courses

- Withdrawing from full-time studies

- Switching programs of study

- Switching educational institutions

- Extending your studies

During your OSAP probation, you can still receive OSAP funding by submitting an Academic Progress form. Please see the OSAP website (https://osap.gov.on.ca/OSAPPortal/en/PostsecondaryEducation/OSAP/Forms/) or the Financial Aid Office to get this form. You will also be expected to pass the courses you registered for. If you don’t pass your courses, you will then be restricted from OSAP funding for a minimum of 12 months.

An emergency loan fund has been established to assist students who run into financial difficulty during the school year. An Emergency Loan is normally granted to OSAP students who have not received their OSAP funding yet. If you are not an OSAP student, please contact our office to see if you qualify based on your circumstances. The Emergency Loan is repayable within 30 days. Applications for these short-term loans are available at the Financial Aid Office. Please email financialaid@stclaircollege.ca for further information.

We also have many internal and external financial aid opportunities available through scholarships and bursaries. For more information on Internal & External Financial Aid Opportunities please visit:

Internal Scholarships and Bursaries:

https://www.stclaircollege.ca/financial-aid/internal-scholarships-bursaries

External Scholarships and Bursaries:

https://www.stclaircollege.ca/financial-aid/external-scholarships-bursaries

What Happens After I am done School

While you are in school, the interest on your student loans is paid by the provincial and federal governments.

You are responsible to start repaying your loan six months after completing your studies or when you are no longer a full-time postsecondary student. The interest on your student loan begins to accrue from the time you stop being a full-time postsecondary student.

You will be contacted by the National Student Loans Service Centre shortly before you are scheduled to begin repayment with details on your monthly loan payments and repayment period.

- National Student Loans Service Centre: 1-888-815-4514 or www.nslsc.ca